Tuesday, May 28, 2019

Your looking at whats called a short sale and youll owe money to the lender even after the house is sold. Unfortunately if the information on your credit report is accurate it can stay on your credit report for 75 years.

If it is very important that your particular Atlanta apartment finder allow you to get an Atlanta apartment that is certainly close to work, than the could be the first priority. It offer half an hour drive distance from Gurgaon, 45 minutes drive distance from International Airport, 5 minutes drive from NH8. An old Golden rule, "You need to be a Chevy in a very Cadillac neighborhood" Why.

Oc Mortgage Archives Ryan Grant

Check your credit report first to know where you stand.

Make your credit report unmarred even after foreclosure. Here are a few things to consider doing. Not only will a bankruptcy filing remain on your credit report for seven to ten years but you can expect information about the debts discharged forgiven in bankruptcy to continue to appear on your credit report too. Also the impact to your credit may make it difficult to rent or purchase a home in the future.

By tracking your credit score and waiting until it has returned to a satisfactory level you can maximize your chances of getting approved for a new credit card. Even with a foreclosure still noted on your credit report you can obtain a credit card if your fico score is high enough. While your credit will take a big hit after foreclosure you might be able to get another mortgage after some time passesthe amount of time you have to wait before applying for a new mortgage loan depends on the type of lender and your financial circumstances.

Improving your credit post foreclosure. Many people who have gone through foreclosure wonder if they will ever able to buy a house again. As you are aware from your first purchase credit scores play a big part in the loan you qualify for.

What is better on your credit report foreclosure or bankruptcy. In some states you may be required to pay a portion of your mortgage debt even after the home has entered foreclosure. There is nothing that can be done about the entry on foreclosure on your credit report.

In this article youll learn what shouldand should notshow up on your credit report after you receive a bankruptcy discharge and what to do if your. The presence of a foreclosure on your credit report probably will make it difficult to obtain new credit at the best rates especially if you also have problems with other credit accounts. A foreclosure remains on your credit report seven years so it will have a long term effect on our creditworthiness.

The key will be what you do from here. It may be best to explore other options to foreclosure with your mortgage company before making a decision to leave your home. Keep balances low and pay off any balances in a timely manner instead of moving it around.

Your credit report will reflect each of the accounts you included in your bankruptcy. Even though the bankruptcy information will remain on your credit report for seven to 10 years you can sometimes begin rebuilding your credit soon after your debts have been discharged. Stay current on your payments.

The best way to improve your credit is to pay on time and to keep balances low less than 30 of your credit limit and lower is better. However it is still important to check your credit report regularly as this will allow you to correct any inaccuracy that might make your credit score to fall further.

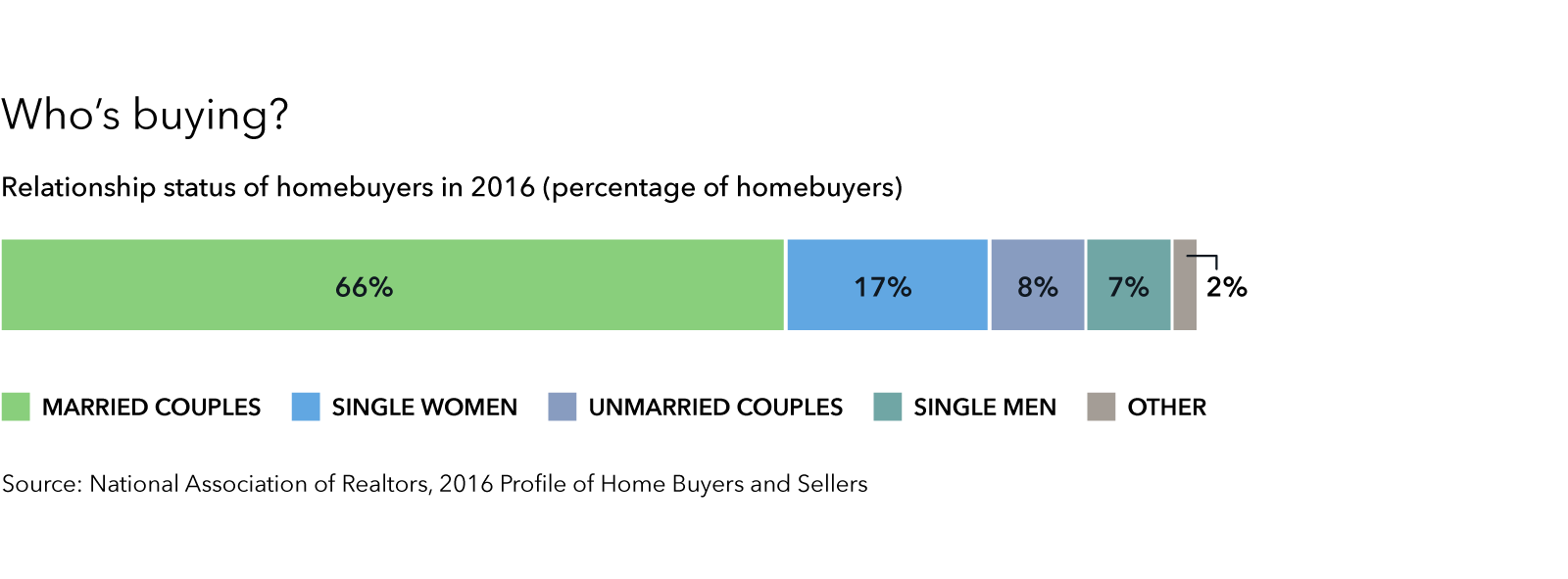

Making The Move To Homeownership On Your Own Or With Someone Else

Stbc Resources

In The Supreme Court Of Ohio

Mui Encompass User Manual

Search

Featured Post

Decluttering Before You Sell Helps Reduce The Stress Of Moving

If it is very important your Atlanta apartment finder allow you to get an Atlanta apartment thats all-around work, this may be the first pr...

Popular Posts

-

The process of purchase is actually easy and is found out in a little search. It offer thirty minutes drive distance from Gurgaon, 45 minu...

-

Voted the best attraction in the state by the illinois office of tourism starved rock state park is the perfect destination for a weekend g...

-

The orange county resort is one of the best luxury resorts in coorg. The bungalow club resort is situated in the western valley. ...

Categories

- 150 best cottage and cabin ideas

- 150 best cottage and cabin ideas book

- 150 best cottage and cabin ideas pdf

- best beach cottage names

- best brand cottage cheese

- best brand cottage cheese for weight loss

- best buy cottage cheese

- best cottage airbnb ontario

- best cottage areas in ontario

- best cottage areas in quebec

- best cottage areas near montreal

- best cottage areas near ottawa

- best cottage areas near toronto

- best cottage at knoebels

- best cottage board games

- best cottage booking website

- best cottage business ideas

- best cottage cheese australia

- best cottage cheese brand

- best cottage cheese brand canada

- best cottage cheese brand for baby

- best cottage cheese brand for keto

- best cottage cheese brand for weight loss

- best cottage cheese brand reddit

- best cottage cheese brands in india

- best cottage cheese brands uk

- best cottage cheese for baby

- best cottage cheese for diabetics

- best cottage cheese for keto diet

- best cottage cheese for muscle building

- best cottage cheese pancakes

- best cottage cheese pancakes ever

- best cottage cheese pancakes recipe

- best cottage cheese recipes

- best cottage cheese recipes bodybuilding

- best cottage cheese salad

- best cottage cheese toppings

- best cottage country in ontario

- best cottage decorating ideas

- best cottage design ideas

- best cottage dinner recipes

- best cottage floor plans

- best cottage garden book

- best cottage garden plants australia

- best cottage getaways uk

- best cottage heating system

- best cottage holiday websites

- best cottage homes for sale

- best cottage house designs

- best cottage house plans

- best cottage in coonoor

- best cottage in coorg

- best cottage in kodaikanal

- best cottage in kolkata

- best cottage in manali

- best cottage in matheran

- best cottage in nainital

- best cottage in ooty for family

- best cottage in sajek

- best cottage in scotland

- best cottage lake district

- best cottage lakes near ottawa

- best cottage lakes near toronto

- best cottage locations in ontario

- best cottage near london

- best cottage pie guardian

- best cottage pie in dublin

- best cottage pie recipe

- best cottage pie recipe delia

- best cottage pie recipe eat well for less

- best cottage pie recipe gordon ramsay

- best cottage pie recipe ground beef

- best cottage pie recipe in the world

- best cottage pie recipe jamie oliver

- best cottage pie recipe mary berry

- best cottage pie recipe nigel slater

- best cottage pie recipe nz

- best cottage pie recipe uk

- best cottage places in ontario

- best cottage rental sites in ontario

- best cottage rental website ontario

- best cottage rental websites

- best cottage rental websites uk

- best cottage rentals near ottawa

- best cottage rentals ontario

- best cottage resort in goa

- best cottage resorts in ontario

- best cottage resorts in ooty

- best cottages in kodaikanal

- best cottages in kodaikanal for family

- best cottages in manali

- best cottages in ooty for couples

- best cottages in ooty for family

- best cottages on airbnb

- best cottages on airbnb uk

- best cottages on skye

- best ever cottage pie

- best ever cottage pie nz

- best family cottage rentals ontario

- best family cottage resorts ontario

- best natural cottage cheese

- best nonfat cottage cheese

- filing bankruptcy to stop foreclosure

- flip or rent houses

- flip or rent property

- living in miami beach florida

- property auctions

- property auctions florida

- property auctions houston

- property auctions indiana

- property auctions michigan

- property auctions near me

- property auctions nj

- property auctions online

- property auctions texas

- property auctions uk

Blog Archive

-

▼

2019

(252)

-

▼

May

(32)

- Energy Consumption A Factor In Buying A Home

- Brewer Caldwell Asks Do You Really Need A Property...

- Advantages Of Hiring Realty Rental Companies

- 7 Reasons Why Your House Isnt Selling

- Packing Pointers For Homeowners On The Move

- The Kelowna Real Estate Have Many Opportunities To...

- Living In Miami Beach Florida

- Contact A Professional Home Builder For Reliable S...

- Things That You Should Know Before Buying A Forecl...

- Qualities That A Perfect Realtor Should Have

- How To Increase The Real Estate Value Of Your Home

- Buying On Panamas Caribbean

- Selling Adding Value Not Personal Touches

- Real Estate Staging Best Practices

- Do You Know Why You Must Find Your Next Home In Su...

- Alternative Real Estate Modular Homes Vs Manufactu...

- Million Solar Roof Initiative Us Department Of Energy

- A Guide To Buying Property In The Costa Del Sol

- Making Calgary Homes Comfortable

- The Right Neighborhood Matters

- Property Auctions

- Submitting A Complete Short Sale Packet

- How To Maximize Your Profit Margin When Developing...

- Tips For Choosing Your Perfect Actual Class Medicine

- Home Extension A Basic Requirement For All Growing...

- What Is Foreclosure What You Should Really Know

- Real Estate Investment Loan Two Critical Things To...

- Locating Property In Ni Northern Ireland

- Make Your Credit Report Unmarred Even After Forecl...

- Indian Economy One Of The Biggest Economies In The...

- Mortgage Rates Steady Into February

- Three Simple Tips For Selling Your House Fast

-

▼

May

(32)

0 comments:

Post a Comment