Your looking at whats called a short sale and youll owe money to the lender even after the house is sold. Unfortunately if the information on your credit report is accurate it can stay on your credit report for 75 years.

If it is very important that your particular Atlanta apartment finder allow you to get an Atlanta apartment that is certainly close to work, than the could be the first priority. It offer half an hour drive distance from Gurgaon, 45 minutes drive distance from International Airport, 5 minutes drive from NH8. An old Golden rule, "You need to be a Chevy in a very Cadillac neighborhood" Why.

Oc Mortgage Archives Ryan Grant

Check your credit report first to know where you stand.

Make your credit report unmarred even after foreclosure. Here are a few things to consider doing. Not only will a bankruptcy filing remain on your credit report for seven to ten years but you can expect information about the debts discharged forgiven in bankruptcy to continue to appear on your credit report too. Also the impact to your credit may make it difficult to rent or purchase a home in the future.

By tracking your credit score and waiting until it has returned to a satisfactory level you can maximize your chances of getting approved for a new credit card. Even with a foreclosure still noted on your credit report you can obtain a credit card if your fico score is high enough. While your credit will take a big hit after foreclosure you might be able to get another mortgage after some time passesthe amount of time you have to wait before applying for a new mortgage loan depends on the type of lender and your financial circumstances.

Improving your credit post foreclosure. Many people who have gone through foreclosure wonder if they will ever able to buy a house again. As you are aware from your first purchase credit scores play a big part in the loan you qualify for.

What is better on your credit report foreclosure or bankruptcy. In some states you may be required to pay a portion of your mortgage debt even after the home has entered foreclosure. There is nothing that can be done about the entry on foreclosure on your credit report.

In this article youll learn what shouldand should notshow up on your credit report after you receive a bankruptcy discharge and what to do if your. The presence of a foreclosure on your credit report probably will make it difficult to obtain new credit at the best rates especially if you also have problems with other credit accounts. A foreclosure remains on your credit report seven years so it will have a long term effect on our creditworthiness.

The key will be what you do from here. It may be best to explore other options to foreclosure with your mortgage company before making a decision to leave your home. Keep balances low and pay off any balances in a timely manner instead of moving it around.

Your credit report will reflect each of the accounts you included in your bankruptcy. Even though the bankruptcy information will remain on your credit report for seven to 10 years you can sometimes begin rebuilding your credit soon after your debts have been discharged. Stay current on your payments.

The best way to improve your credit is to pay on time and to keep balances low less than 30 of your credit limit and lower is better. However it is still important to check your credit report regularly as this will allow you to correct any inaccuracy that might make your credit score to fall further.

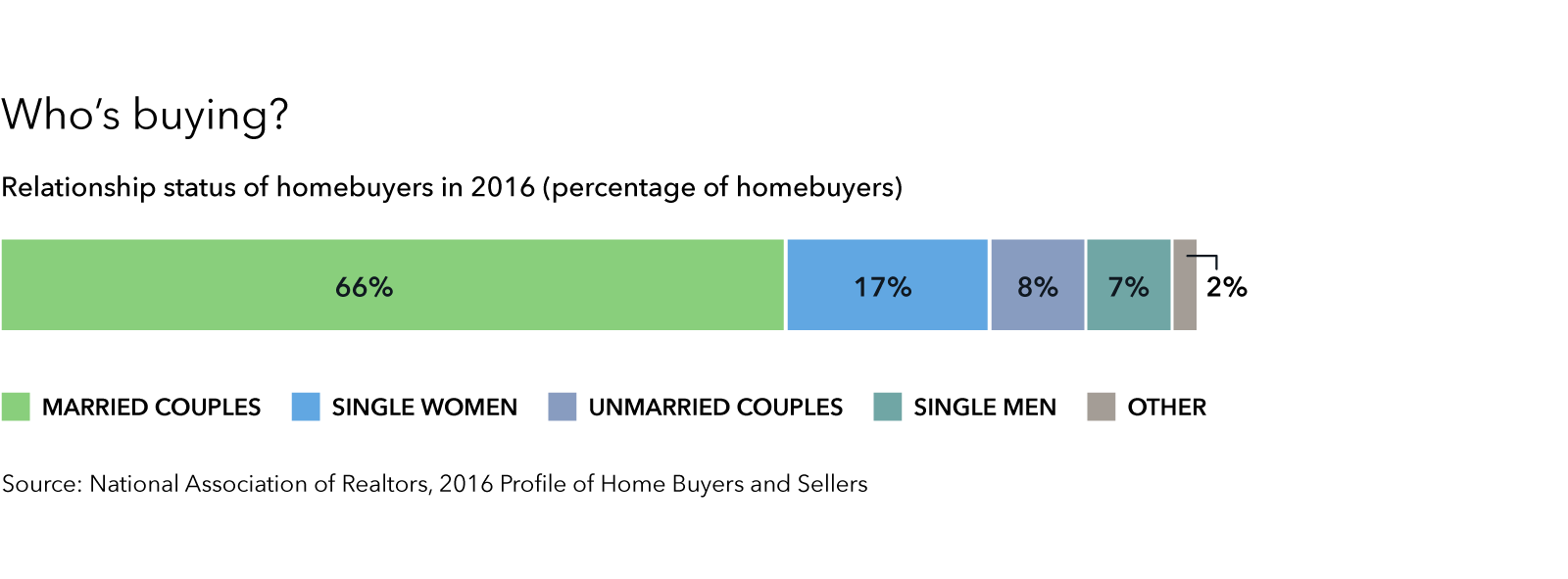

Making The Move To Homeownership On Your Own Or With Someone Else

Stbc Resources

In The Supreme Court Of Ohio

Mui Encompass User Manual

No comments:

Post a Comment